27 Feb When Do Asset-Based Loans Make the Most Sense?

Every business, regardless of size or industry, experiences periods where cash flow becomes a challenge. Whether it’s due to seasonal fluctuations, rapid growth, or delayed customer payments, having access to financing is crucial to keep operations running smoothly.

An asset-based loan (ABL) is a powerful financing option that allows businesses to leverage their assets—such as inventory, accounts receivable, and equipment—to secure funding.

But when do asset-based loans make the most sense? In this article, we’ll explore when an asset-based loan is the right choice and how it can help businesses maintain stability and seize opportunities.

What Is an Asset-Based Loan?

An asset-based loan is a type of financing where a business uses its assets as collateral to secure a loan. This can include:

- Accounts receivable (unpaid customer invoices)

- Inventory (raw materials, finished goods)

- Equipment (machinery, vehicles)

- Real estate (commercial properties)

The amount a business can borrow depends on the value of its assets. Lenders typically offer a percentage of the appraised value of these assets, ensuring businesses can access capital without needing strong cash flow or pristine credit.

Now, let’s explore when an asset-based loan makes the most sense for a business.

1. When Your Business Has Strong Assets but Irregular Cash Flow

Many businesses have valuable assets but struggle with cash flow due to delayed payments or seasonal revenue fluctuations. Asset-based loans can provide the liquidity needed to bridge the gap between revenue cycles.

For example, a manufacturing company may have a large volume of accounts receivable but experience slow payments from clients, or a retail business may have a significant amount of inventory but sales fluctuate depending on the season. An asset-based loan allows these businesses to convert assets into cash without waiting for payments or peak sales periods.

2. When You Need More Financing Than a Traditional Loan Can Offer

Traditional business loans are often based on creditworthiness, profitability, and cash flow. If your business does not meet strict lending criteria, securing a loan can be difficult. Asset-backed lending provides a solution by focusing on the value of your assets rather than financial statements alone.

For example, a wholesale distributor with substantial inventory but inconsistent profits may struggle to qualify for a traditional loan. However, by leveraging its inventory as collateral, it can secure funding through an asset-based loan to cover operational costs and expand.

3. When Your Business Is Growing Rapidly and Needs Capital

Growth requires capital, but many businesses struggle to fund expansion without straining existing cash flow. An asset-based loan can be an effective way to finance growth while maintaining financial stability.

For instance, a construction company winning multiple contracts might need capital to purchase materials and equipment before receiving payments from clients. A technology firm experiencing a surge in demand might need immediate funding to invest in additional staff and product development. Rather than waiting for revenue to catch up with expenses, businesses can use their assets to unlock capital and sustain growth.

4. When Your Business Has Significant Accounts Receivable

If a business has a large number of unpaid invoices, it means working capital is tied up, delaying essential expenses like payroll, rent, and supplies. Asset-based lending allows businesses to borrow against their receivables and get immediate access to cash.

For example, a B2B service provider with long payment terms (around 60 to 90 days) can use an asset-based loan to maintain cash flow while waiting for payments. A healthcare practice waiting on insurance reimbursements can secure funding against outstanding claims to cover operational expenses. By leveraging accounts receivable, businesses can smooth out cash flow inconsistencies without waiting for payments to arrive.

5. When You Need More Flexible Financing Options

Unlike traditional term loans, asset-based loans provide flexible borrowing options, allowing businesses to access funds as needed. Many asset-based loans work as revolving lines of credit, meaning businesses can borrow and repay funds multiple times, similar to a credit card.

This flexibility is ideal for businesses with ongoing financial needs, such as:

- Manufacturers that need to continuously restock raw materials.

- Retailers that adjust inventory levels based on seasonal demand.

- Staffing agencies that need to cover payroll while waiting for client payments.

With an asset-based revolving credit line, businesses can draw funds when needed and repay them as revenue comes in, reducing overall borrowing costs.

6. When You Want to Avoid Personal Guarantees

Many traditional loans require personal guarantees, meaning business owners must pledge personal assets (such as homes or savings) as collateral. With asset-based lending, the business itself provides the collateral, reducing personal risk.

For business owners who want to protect their personal assets, an asset-based loan is often a safer alternative to securing financing.

7. When Your Business Has Been Denied a Traditional Loan

If your business has been denied a loan due to low credit scores, inconsistent cash flow, or high debt levels, an asset-based loan may still be an option. Because lenders focus on collateral rather than credit history, businesses with less-than-perfect financials can still qualify for financing.

For example, a transportation company with high equipment costs but a strong fleet can leverage trucks and vehicles as collateral. A newly established business that lacks a long financial history but owns valuable inventory can secure funding against its stock.

Asset-based lending offers a viable non-bank business loan solution for businesses that struggle with traditional loan approval requirements.

Is an Asset-Based Loan Right for Your Business?

An asset-based loan can be a powerful financial tool, but it’s essential to evaluate whether it’s the best fit for your business. Consider these factors:

- Do you have substantial business assets? If you own accounts receivable, inventory, or equipment, an asset-based loan is a great option.

- Do you experience cash flow fluctuations? If your business struggles with seasonal demand or delayed payments, an ABL can provide stability.

- Do you need flexible access to capital? If you prefer a line of credit rather than a lump sum loan, asset-based financing can help.

- Have you struggled to qualify for traditional financing? If your credit score or financial history is preventing you from securing a loan, an ABL can be an alternative business financing

Asset-based loans make the most sense when businesses need quick, flexible financing but lack strong cash flow or credit history. Whether you’re looking to manage cash flow, fund growth, or secure capital without personal guarantees, an ABL provides an effective financing option.

Video

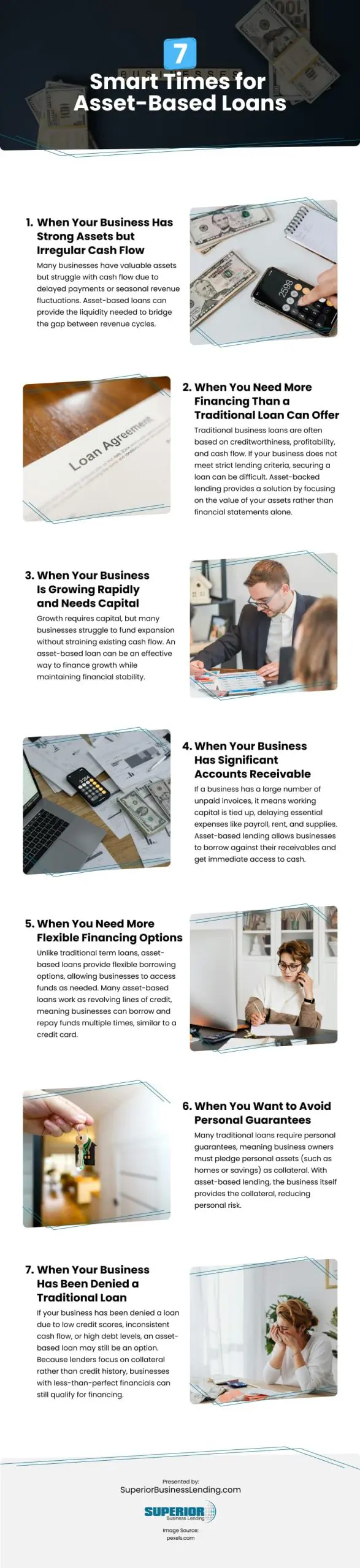

Infographic

All businesses, regardless of size or industry, encounter cash flow challenges. An asset-based loan (ABL) allows them to leverage assets like inventory and accounts receivable for funding. This infographic highlights when an ABL is most beneficial.