21 Jan Where to Get a Business Loan (Besides a Bank)

Securing a business loan is crucial for many organizations looking to expand operations, purchase new equipment, or simply ensure steady cash flow. While traditional banks are a popular option, there are numerous alternative sources that can provide the funding you need.

Understanding these alternatives is essential for finding the right fit for your business needs. Let’s explore various avenues to secure a business loan besides a bank.

Why Look Beyond Banks?

Before diving into the alternatives, it’s essential to understand why looking beyond banks can be advantageous.

- Flexibility: Many alternative lenders offer more flexible terms than traditional banks, catering to the unique financial situations of different businesses.

- Speed: The approval process for alternative loans is often much faster, providing funds when they are needed urgently.

- Accessibility: Alternative lenders may have less stringent requirements, making it easier for businesses with lower credit scores or less established credit histories to obtain loans.

Top Alternative Sources for Business Loans

1. Online Lenders

Online lenders have become increasingly popular due to their convenience and speed. These platforms often have streamlined applications and quick approval processes.

- Pros: Fast approval, less paperwork, flexible terms.

- Cons: Higher interest rates compared to traditional banks.

2. Credit Unions

Credit unions often provide lower interest rates and more personalized service compared to traditional banks. They are member-owned, which often results in terms that are more favorable for borrowers.

- Pros: Lower interest rates, community-focused service.

- Cons: Membership requirements, smaller loan amounts.

3. Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with investors. These platforms facilitate loans through a crowd-sourcing mechanism, offering an alternative to traditional financial institutions.

- Pros: Competitive interest rates, accessible to those with varying credit scores.

- Cons: It may require strong business plans to attract investors, and they often come with platform fees.

4. Invoice Factoring

Invoice factoring involves selling your unpaid invoices to a factoring company at a discount. This provides immediate cash flow while the factoring company waits for payment from your customers.

- Pros: Immediate cash flow, no need for collateral.

- Cons: High fees, relies on customer reliability for invoice payments.

5. Business Grants

While not technically a loan, business grants are worth considering. These are funds provided by government bodies, non-profits, or corporations that do not need to be repaid.

- Pros: No repayment required, fosters business growth.

- Cons: Highly competitive, extensive application processes.

6. Microloans

Microloans are small loans typically offered by non-profit organizations or community lenders. They are especially beneficial for startups and small businesses that need a smaller amount of capital.

- Pros: Easier to qualify for, supportive to startups and small enterprises.

- Cons: Smaller loan amounts, possibly higher interest rates.

7. Merchant Cash Advances (MCA)

MCAs provide upfront capital in exchange for a percentage of future credit card sales. This option is suitable for businesses with high credit card sales volume.

- Pros: Quick access to capital, flexible payment based on sales.

- Cons: High fees and interest rates, daily or weekly repayments.

8. Equipment Financing

This type of loan is used specifically to purchase equipment. The equipment itself serves as collateral, which can make it easier to obtain the loan.

- Pros: Equipment serves as collateral, tax deductions for equipment depreciation.

- Cons: Limited to equipment purchases, possible higher interest rates.

9. Crowdfunding

Crowdfunding platforms allow businesses to raise small amounts of money from a large number of people. Funding can come in the form of donations, pre-orders, or equity investment.

- Pros: Generates public interest and marketing, no repayment if reward-based.

- Cons: Requires significant marketing efforts, no guaranteed funding.

How to Choose the Right Loan Option

Selecting the right loan depends on several factors:

- Business Needs: Determine whether you need a lump sum, ongoing financing, or specific-purpose funding.

- Financial Health: Assess your credit score, income stability, and existing debts.

- Loan Terms: Evaluate the interest rates, repayment terms, and any additional fees.

- Urgency: Consider how quickly you need the funds.

Conclusion

Exploring alternative sources for business loans can provide the flexibility, speed, and specialized support that traditional banks may not offer. By understanding the pros and cons of each option, businesses can make informed decisions that align with their financial goals and operational needs. Whether you need quick capital, have lower credit, or want to avoid high interest rates, there’s likely an alternative lending source that’s right for you.

For businesses looking to thrive and grow, these alternative funding sources offer valuable opportunities to secure the necessary resources without the strict limitations of conventional bank loans. Consider your specific needs, evaluate the options, and choose the best path for your business success.

To talk about your business financing options, consult with one of our highly experienced financial officers at Superior Business Lending. We can find the right avenue for you to secure financing for your business.

Video

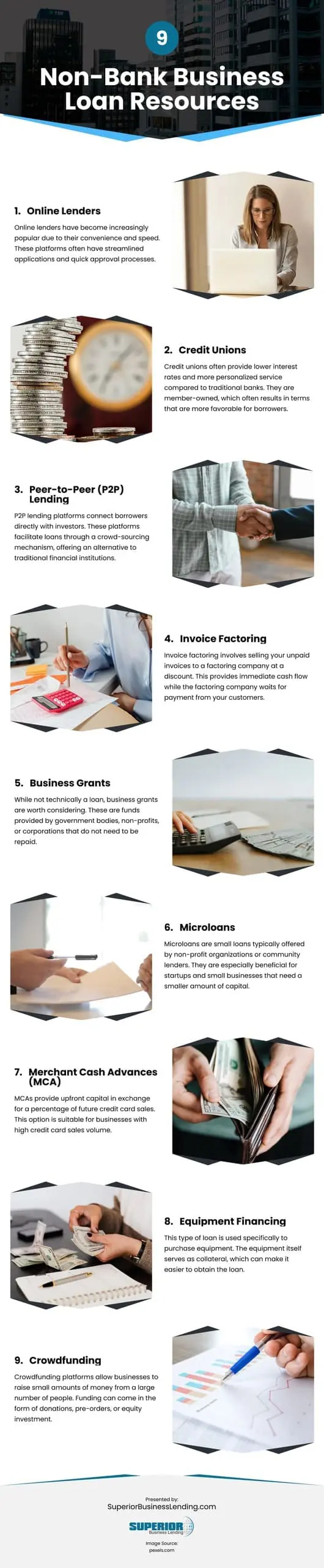

Infographic

Securing a business loan is vital for organizations looking to expand, purchase equipment, or maintain cash flow. While traditional banks are a common option, various alternative funding sources exist. To find the best fit for your needs, explore this infographic on securing business loans beyond traditional banks.